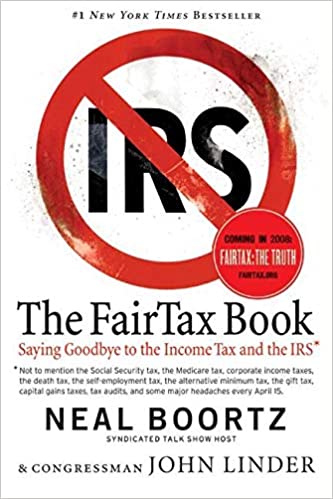

Neal Boortz – The Fair Tax Book Audiobook

Neal Boortz – The Fair Tax Book Audiobook (Saying Goodbye to the Earnings Tax and the IRS)

The Fair Tax Book Audiobook

One thing that few have mentioned when it come to the “numerous different” money that might be added to the financial local weather (previous the pusher, lady of the streets, and in addition underground financial conditions), are these which might be NOT used. The Fair Tax Book Audiobook Free. People who commerce on the securities market pay capital beneficial properties tax obligations, nevertheless they presently pay completely nothing to Social Safety or Medicare. Exact same chooses realty patrons/sellers. The FairTax will definitely generate substantial earnings (and by many accounts the 23% inclusive tax obligation is bigger than what the true tax will surely require to be to make the federal government tax obligation earnings earnings impartial), and in addition the pointless administrative fees (over $500 Billion/12 months) that we spend to simply be licensed with the present income tax obligation will surely be cleaned away.

Yet another issue of detractors are for the “transitionary” interval. People who maintain Roth IRAs are going to face and in addition grumble that these with regular IRAs which might be alleged to be taxed when cash is gotten are getting an unreasonable benefit as a result of the Roth elements have truly already paid earnings tax obligations on their cash the place as the usual Particular person Retirement Account people haven’t. To these, I state this: don’t cease this from present process which all of us will profit for to spite those who profit a bit bit further. If you happen to want to complain, inform your congressmen to supply you again a number of of that curiosity-bearing account money WHEN THE FAIRTAX HAS ACTUALLY BEEN ESTABLISHED. Sadly, I imagine the demise of the Fairtax stays within the understanding that contributions made within the UNFAIR system won’t be compensated for within the transition to a Fairtax. As soon as once more, though everybody obtains there might be those who bathroom the method down as a result of someone is gaining higher than they’re … a floor that’s fertile for political leaders to take advantage of to place the kabash on the Fairtax.

One other factor: DO NOT LET THE GOVERNMENT SPENDING PROBLEM GET IN THE WAY OF IMPLEMENTING THIS. I used to be being attentive to a radio program the place a caller referred to as to tout the Fairtax in addition to the host shortly claimed “nicely, I assume the larger concern stays in federal authorities investing.” Individuals, the issue individuals do not give a rattling regarding authorities investing is because of the truth that they’re oblivious to how a lot of their very own money goes to the federal authorities. We are able to strike spending as soon as it turns into clear to each individual how a lot money they’re providing the federal authorities. MAKE THE FAIRTAX HAPPEN NOW.

To me that is such a chunk of cake it is dispiriting to imagine that there are numerous critics. For a few years I’ve heard individuals say that the federal authorities can pay for this or that. Get up. We’re the federal government’s pocketbooks. When organizations pay much more taxes, that primary cost them to the general public … us. The authorities is gathering this cash in lots of method ins which the general public has shed observe. We pay taxes on earnings, prices, conserving and dying.

Some individuals imagine that they’re getting ‘federal authorities cash’ after they get their tax ‘reimbursement’ again. They put out of your mind that the cash was extracted from their paycheck every pay length.

There are various issues to consider concerning the present taxing system. A minimal of take a look at the book previous to composing your thoughts primarily based on viewpoints by folks that have clearly not take a look at the book or do not perceive the rules. I’ve but to overview a rebuttal that considers the massive image. Certain there can, and probably will, be points within the shift; nevertheless, we can’t proceed alongside the present path of taxation. The Fair Tax obligation Book clarifies this revolutionary technique in plain English and does one thing much more improbable. It makes it amusing. Definitely in case you are looking for a socialist paradise, the Fair Tax obligation is just not what you search. It is going to most positively fall brief in Karl Marx’s objectives of penalizing success in addition to discouraging private financial savings. Ask your self one query: The quantity of occasions have you ever made foolish choices because you had been desirous about tax penalties? Have you ever mistimed an opportunity or averted one altogether since you had been in fear of tax obligation penalties or sustaining the fashion of the Inner Income Service? Neal Boortz – The Fair Tax Book Audio Book Online. In The Fair Tax Publication Neal Boortz in addition to John Linder present you why it doesn’t have to be on this method. They make clear in abnormal and generally humorous language why this technique will enable the federal authorities to be moneyed at current ranges with ABSOLUTELY NO affect to the dangerous and in addition create a tax ambiance the place people don’t must concern their authorities. Learn this book and you’ll comprehend additionally.